For many farm and ranch families, bringing children or grandchildren into the operation is the ultimate goal. Successfully bringing additional family members into the operation may require some creativity, as all parties need to maintain a viable standard of living. This article is part of a series that will highlight ideas and tactics for bringing another family member into the operation. If this is the first article you are seeing in this series, I encourage you to go back to the previous articles for background and additional guidance.

Life insurance can be a key tool for farm and ranch businesses to provide tax-free death benefits at the death of the insured if the policy is structured correctly. This article will discuss how life insurance should be structured and the different types of life insurance.

Policy Structure

Life insurance policies have three parties: (1) the owner, (2) the insured, and (3) the beneficiary. The owner of the policy is responsible for paying the premium and has the authority to change the beneficiaries, adjust the coverage amount, or surrender the policy. The insured is the person whose life is covered by the policy. If the owner and insured are different parties, the owner must have an insurable interest in the life of the insured at the start of the policy. The beneficiary is the person who receives the death benefit (money) at the death of the insured.

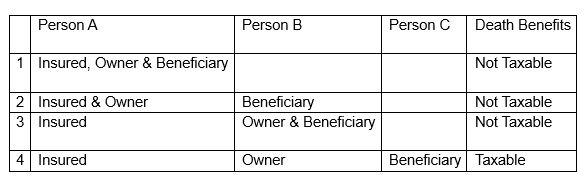

In general, for death benefits to be tax-free to the beneficiary, at least two of these parties need to be the same person. The table below shows a situation with three people: Person A, Person B, and Person C. Each scenario shows if the death benefits are taxable based on the structure of the policy.

Types of Policies

There are two main types of life insurance: permanent and term.

Permanent life insurance can last for the life of the insured, as long as the policy premium is/has been paid. There are several types of permanent life insurance, including whole life insurance, universal life insurance, variable life insurance, and second to die policies. Usually, permanent life insurance policies are more expensive than term policies. They can be used for estate equalization, funding buy-sell agreements, and paying estate taxes. The owner of a permanent life insurance policy may also have the ability to borrow from the cash value, use the cash as collateral for a loan, or receive the policy dividends.

Term life insurance lasts for a specified period of time, as long as the policy premium is paid. Term life insurance policies are often used for debt coverage and income replacement. Typically, term life insurance policies are more affordable than permanent life insurance policies.

Additionally, some term policies can be converted to permanent policies without the insured needing to go through medical testing, but only during the conversion period of the policy.

The type of policy that you select will depend on the purpose of the policy. Future articles will discuss what types of policies should be used in agricultural businesses for debt coverage, inheritance equalization, funding buy-sell agreements, and income replacement.

Life insurance may be a valuable tool to provide liquidity for a farm or ranch business. However, depending on your situation, policies may be cost prohibitive or unavailable. The amount of the death benefit, the insured's age, health status, occupation, lifestyle, and other factors can influence the cost of the insurance premiums. Some people are simply uninsurable.

Jessica Groskopf is a Regional Extension Economist with the Center for Agricultural Profitability at the University of Nebraska–Lincoln. Cindy Bojanski, CFP®,RICP® is a Financial Advisor at Coordinated Planning.

+++++++

The material in this article is intended for educational purposes and is not intended to provide specific advice or recommendations for any individual, nor does it consider the particular investment objectives, financial situation or needs of individual investors. The authors of this article do not offer tax or legal advice. Any tax or legal related information is provided as general education and is incidental to the topic of financial planning. You should seek specific tax or legal advice from your tax or legal professional before pursuing any idea contemplated herein.

Securities offered through Valmark Securities, Inc. (“VSI”) Member FINRA, SIPC. Investment Advisory services offered through Valmark Advisers, Inc. (“VAI”) a SEC Registered Investment Adviser. Coordinated Planning is a separate entity from VSI and VAI. Jessica Groskopf is not affiliated with VSI and VAI. Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP® in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.